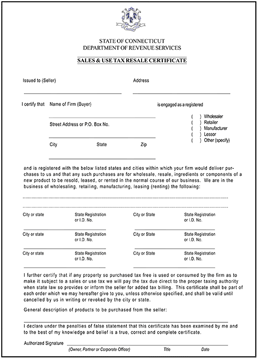

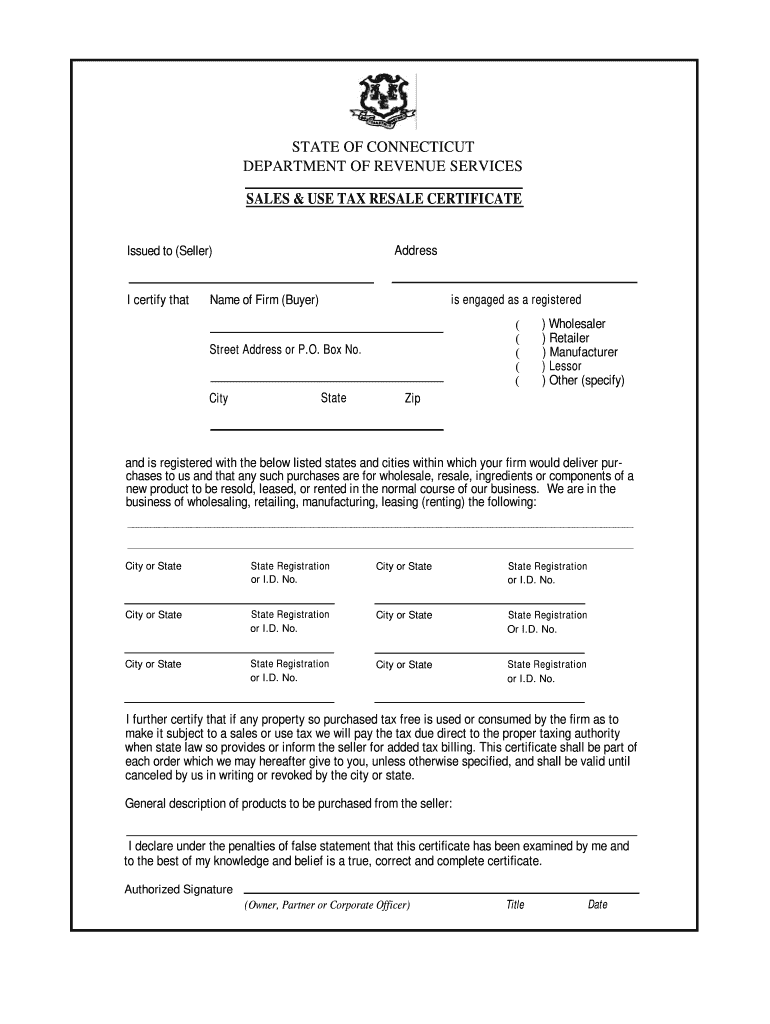

ct sales tax exemption form

Request for Taxpayer Identification Number TIN and Certification. Sales tax exemption certificates are required whenever a seller makes a sale of taxable goods or services and does not collect sales tax in a jurisdiction in which they are required to.

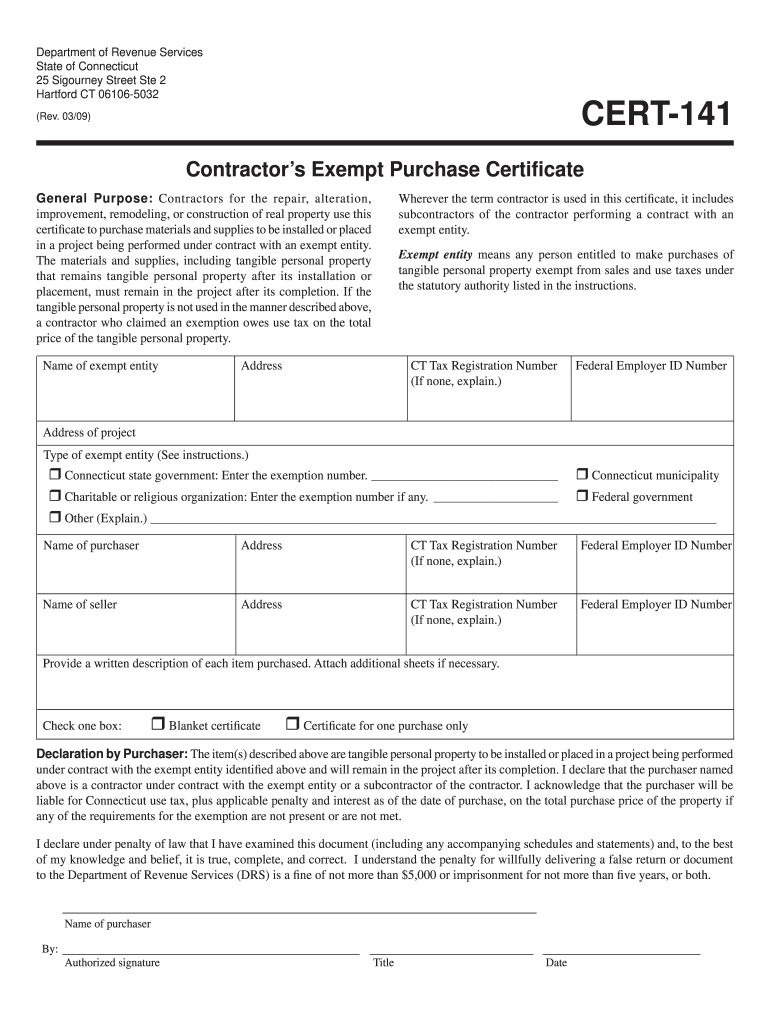

Whether or not you are a construction contractor the sales and use tax rules regarding this industry affect you.

. A tax exempt certificate is issued to an entity that qualifies for an exemption or because the purchased item qualifies for the exemption. Limited items are exempt from sales tax. Also see Life Insurance Company Guaranty Corporation credit CT-34-SH.

The late payment penalty is 15 or 50 for all tax types. Access Owners Certification Form a Workers Compensation Coverage Affidavit Certificate of Liability Insurance and Non-Owners Affidavit. 1 Some businesses are not required to hold a sellers permit for example a business may not make sales in this state or it may not sell property that is subject to sales tax when sold at retail.

Individual Tax Return Form 1040 Instructions. Absent strict compliance with these requirements Oklahoma holds a seller liable for sales tax due on sales where the claimed exemption is found to be invalid for whatever reason unless the Tax Commission determines that purchaser should be pursued for collection of the tax resulting from improper presentation of a certificate. Claim for Retaliatory Tax Credits.

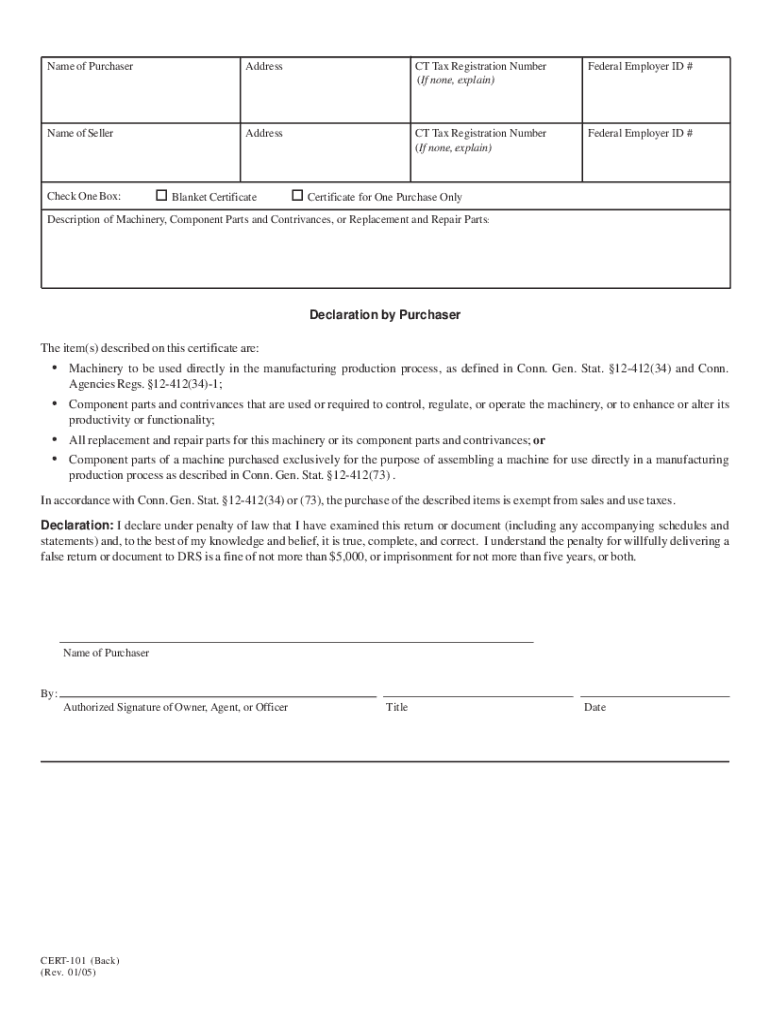

License from CT Department of Health Form CERT-113 IRS 501c3 letter Farmer Tax Exemption Permit Form CERT-100 or Form CERT-101 or Form CERT-108 Partial or Form. Exemption extends to sales tax levied on purchases of restaurant meals. A Buyer has salesuse tax nexus in a state if the Buyer has physical presence in that state or has made sufficient sales to customers in that state to have salesuse tax economic nexus.

Many non-contractor businesses are surprised to learn during a state tax audit that what they thought was a nontaxable construction contract is actually considered by Pennsylvania to be a purchase of tangible personal property TPP with. Sales Use Tax Exemption Form CRT-62 or Uniform Sales Use Tax Exemption Form Indiana Form ST-105 or Streamlined Sales Tax Agreement Certificate of Exemption. CT-332-I Instructions Life Insurance Company Guaranty Corporation Credit.

Present sales use tax exemption form for exemption from state hotel tax. South Dakota SD No reciprocity with State of Vermont per 1-800-TAX-9188. The threshold of sales activity needed to establish salesuse tax economic nexus may differ by state.

You must complete section 6 if tax exemption is claimed on the Application for Registration and Title. Instructions for Form 1040 Form W-9. South Carolina SC x No Exemption based on the status of the purchaser.

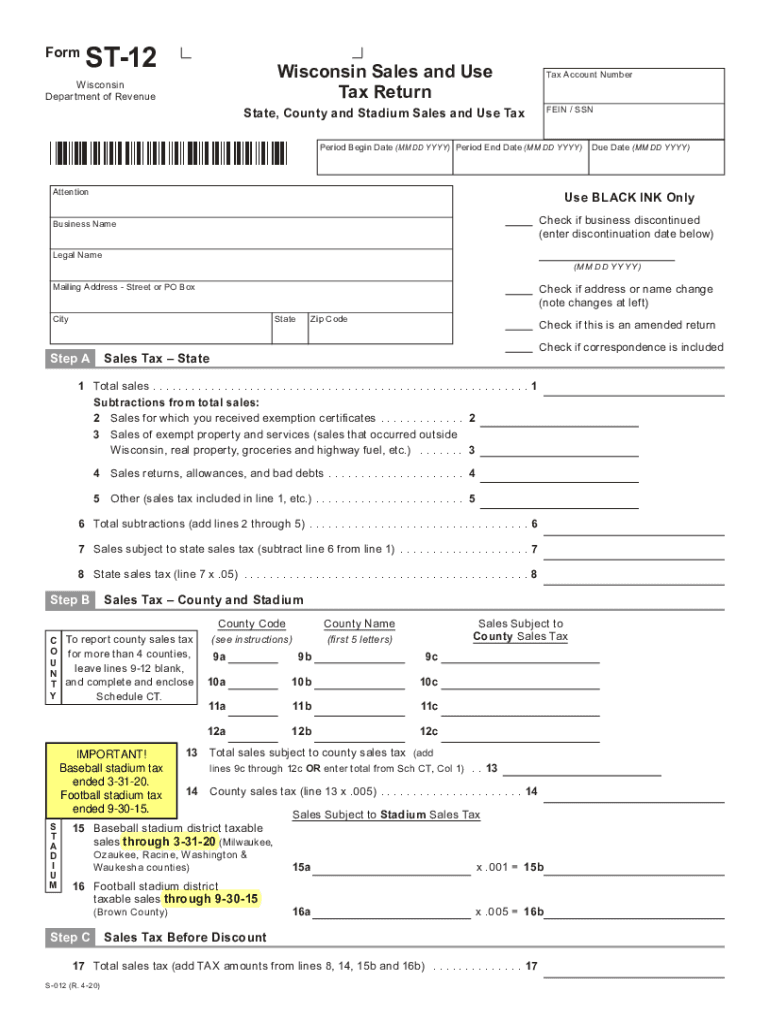

Request For Data Mailer SCRA Non-Resident Active Duty MV Exemption CT Resident Active Duty MV Exemption - SITUS Tax Exempt Organization Application and Quadrennial Renewal and Wheelchair MV. 17 Check if business discontinued enter discontinuation date below MM DD YYYY To report county sales tax for more than 4 counties leave lines 9-12 blank and complete and enclose Schedule CT. If the Buyer is entitled to claim a resale sales tax.

C O U N. A The term sales price applies to the measure subject to sales tax and means the total amount of consideration including cash credit property and services for which personal property or services are sold leased or rented valued in money whether received in money or otherwise without any deduction for the following. Proof is generally provided in the form of an exemption certificate that meets that state.

State government websites with useful information for tax-exempt organizations including registration requirements for charities taxation information for employers and more. If you are selling to a purchaser who is not required to hold a sellers. INTEREST is charged at the rate of 1 per month or fraction of a month from the due date until.

One must research the various tax department web sites or consult with their SALT advisor to determine which form applies. Late filing of Sales tax returns. New Connecticut Residents - New Connecticut residents are not required to pay sales tax if the vehicle was registered in the same name in another state for at least 30 days prior to establishing Connecticut residency.

Non-Life Insurance Corporation Franchise Tax Return. A resale certificate cannot be used to purchase items exempt from sales tax that do not qualify for this purpose. Effective for tax periods ending on or after December 31 2019 the late payment penalty for electronic filers has been changed from a graduated rate to a flat percentage.

Transfer or Sale Between Immediate Family Members. Sales Subject to Stadium Sales Tax Step C Sales Tax Before Discount 17 Total sales tax add TAX amounts from lines 8 14 15b and 16b. For more information please see Sales for Resale Publication 103.

CT-331-I Instructions Claim for CAPCO Credit.

Credit Applications Tarantin Industries

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

Form Reg 8 Fillable Farmer Tax Exemption Permit

Wi Dor St 12 2020 2022 Fill Out Tax Template Online Us Legal Forms

Ct Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online Us Legal Forms

Sales Tax Exemption For Building Materials Used In State Construction Projects

Form Cert 141 Fillable Contractors Exempt Purchase Certificate

Form Ct 206 Fillable Cigarette Tax Exemption Certificate

Cert 101 Fill Online Printable Fillable Blank Pdffiller

Form Cert 134 Fillable Sales And Use Tax Exemption For Purchases By Qualifying Governmental Agencies